简单谈谈新加坡股票 - SGX - 新加坡三大银行 - DBS, OCBC and UOB

大马人倘若投资在新加坡上市公司的股票有什么好处呢?比如正在如日冲天地发展和成长的3大银行?

1)新币的稳定性 - 天然护城河 - 马币对垒新币越来越弱 - 投资在新加坡股票除了让你的资金保值(Natural Hedging Instrument Against Currency Fluctuation Risk) 之外,也能有资本的成长 (Capital Gain in Currency Appreciation)

2)投资在3大银行等同于拥有国际顶端的领袖作为公司发展的导航 - 优秀的高层也是护城河 - 优秀的领导人带领公司走向繁荣进步!若你瞧瞧DBS银行的成长和发展你会明白个中道理!

DBS,OCBC 和 UOB - 你会想要投资哪家银行呢?

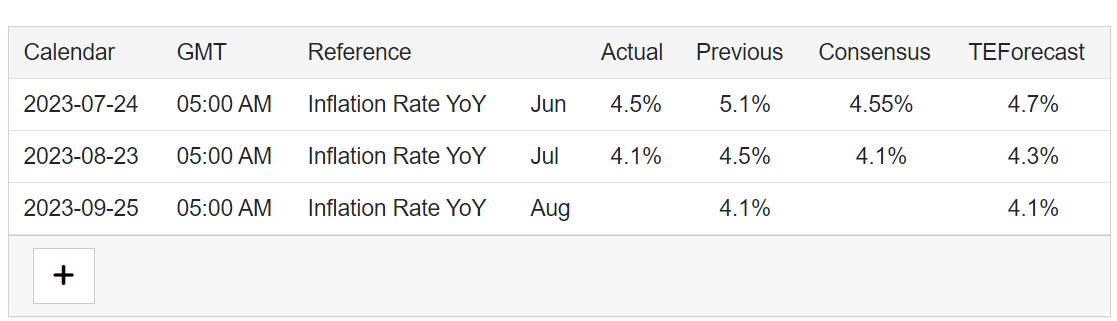

对我而言,我会选择 (1)比较便宜;(2)发展和成长空间比较大;(3)股息非常不错的至少高于通货膨胀率或最好靠近5%,原因是杰截止于2023年7月,数据证明新加坡的通货膨胀率大约是4.1% **** (4)不会高估而且低于合理PE的10

*** 数据出处:Trading Economics - Singapore Inflation Rate

(2) OCBC 新加坡华侨银行

(3) UOB 新加坡大华银行

基于以上的3大银行的数据来比较,

OCBC Ltd (SGX: O39)

OCBC is Singapore’s second-largest bank by market capitalisation and offers a comprehensive range of banking, investment, and insurance services.

The blue-chip lender had reported a stellar set of earnings for its fiscal 2023’s first half (1H 2023).

Surging interest rates benefitted the banks’ net interest income which flowed down to improve its bottom line, with net profit climbing 38% year on year to S$3.6 billion.

In line with the strong results, OCBC hiked its interim dividend by close to 43% year on year to S$0.40.

There could be more good news to come for investors.

The bank launched a major rebranding exercise in July with a refreshed logo and tagline, aiming to deliver an incremental S$3 billion in revenue over the next three years.

This growth trajectory will be driven by four key pillars – Asian wealth, trade and investment flows, new economy, and sustainability.

The US Federal Reserve is also intent on keeping interest rates high to combat inflation and bring it down to the 2% level.

With rates staying high till at least 2024, OCBC should continue to enjoy higher net interest income.

Should the bank carry on reporting robust financial results for 2023, it could up its final dividend early next year.

OCBC股息非常大方,我形容OCBC股息成长为爆炸性成长

总结: 我打算近期内会建仓,然后慢慢累计这个非常有潜能成长+高股息的OCBC。

由于我的时间有限,若要更多资料可以上各银行网站下载年报,通告等。

Remarks:

这个短短的分享

(1)我是为了帮忙一个乐善好施的大马 Dato 生意人物色不错的投资项目(这位善翁很低调,我之前也有推荐好的马股给他,他也大赚一笔然后也是做很多善事,所以帮忙他也帮忙很多不幸的人);

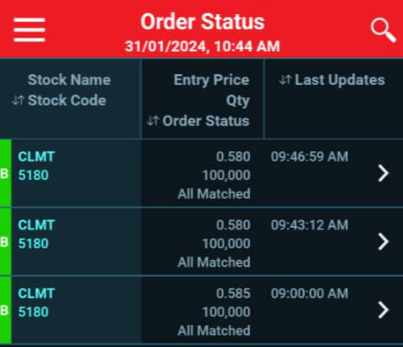

(2)我自己也会在短期内开始建仓OCBC

(3)我本身很喜欢分析财报,财务状况来进行股票投资

(4)我本身也是喜欢分析和分享好的投资项目

下一个分享我会大约分享

(1)SGX: C6L - Singapore Airlines Ltd

(2)Big plans for Changi Airport T5 还有其建成对新加坡还有东南亚的影响特别是马来西亚

(3)SGX: S20 - Straits Trading Company Ltd

(4)SGX: AGS - Hour Glass Ltd

后一个分享我会大约分享

(1)SGX: BUOU - Frasers Logistics & Commercial Trust

(2)SGX: N2IU - Mapletree Pan Asia Commercial Trust

DISCLAIMER:

This post or blog does not constitute BUY/SELL CALLS and it is just for information sharing. The author above won't be responsible for any parties relying on this information for investment decision.

Comments

Post a Comment