Top Management's Responses to my Queries within 24 hours -- CapitaLand Malaysia Trust (CLMT) - Analysis from Q4 FY2018 till Q2 FY2023 + Projection from Q3 FY2023 till Q4 FY2024 + Commentaries

The top management is highly responsive!

I forwarded my insights and questions to them and within 1 day, they responded me!

It is good to have timely update that CLMT has strategised itself to venture into INDUSTRIAL/LOGISTICS REITs in which the Profit Margin is as high as 90%!

For assets in Klang Valley, the newly appointed CEO will be focusing and using Differentiation Strategy for the turnaround plan!

Hopefully, the newly appointed Singaporean CEO will bring his experience and create another Vivo City in Klang Valley!

From time to time, I will be updating everyone here because I will have timely communication with the top management from time to time. I will also be communicating with an Investment Director from Temasik Group whose portfolio in in Real Estate Investment and he is in charge of Singapore REITs! From my communication with the Expert, I will be understanding better in REITs and especially CLMT which is managed and handled by Singaporeans!

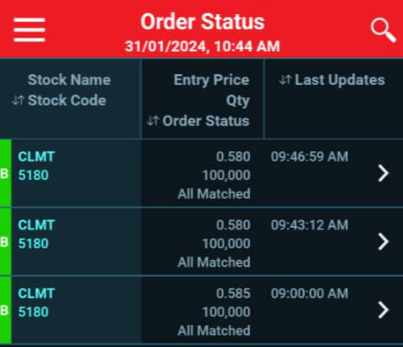

Congratulations to all who has decided and joined me in CLMT when the price was as low as around 50 cents!

Thanks for the info, I do think CLMT has a good prospect. Though I don't think Jasmine is the top management ( Went to check and she appears to be the investor relation, not the top management).

ReplyDeleteHi, Jasmine is from Investor Relation but I do think that she replied after discussing with the CEO. Her answer should be reflecting what has been discussed with and approved by the CEO to avoid offending rule such as insider trading regulation. I know this pretty well because I am in industry similar to this

Delete