(1) GDP - Real (USD) - China (Annual) Economic Time Series Profile; (2) Retail Industry in China

- The China Retail Sector Market size is estimated at USD 1.94 trillion in 2024, and is expected to reach USD 2.87 trillion by 2029, growing at a CAGR of 8.17% during the forecast period (2024-2029).

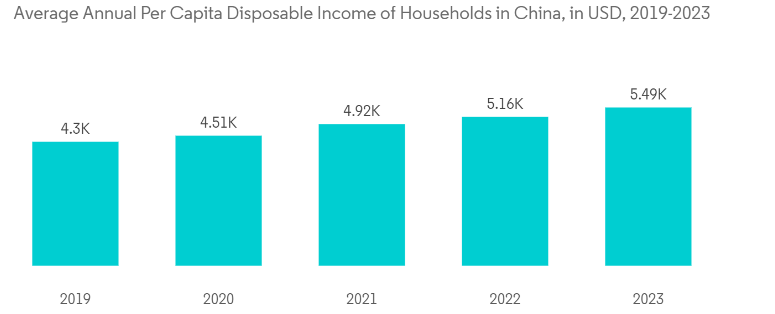

- China's robust economic growth and rising disposable incomes have fueled consumer spending and driven expansion in the retail sector.

- Increased Disposable Income of People is Driving the Market

Salient Points: -

1) How big is the China Retail Sector Market?

- The China Retail Sector Market size is expected to reach USD 1.94 trillion in 2024 and grow at a CAGR of 8.17% to reach USD 2.87 trillion by 2029.

2) What is the current China Retail Sector Market size?

- In 2024, the China Retail Sector Market size is expected to reach USD 1.94 trillion.

3) Is Parkson China ready to adopt e-Commerce?

- Yes, Parkson China has been ready since year 2018. Parkson Group (Stock Code: 3368) signed a strategic cooperation agreement with the largest boutique lifestyle platform Secoo in Asia (NASDAQ:SECO) in Shanghai.

See link here http://www.parksongroup.com.cn/html_en/about_parkson/News_Detail.php?cid=82

4) How big is the Retail Market in China in term of Online Retail Market?

China remains world’s largest online retail market for 11th consecutive year amid booming consumption recovery

See link here https://www.globaltimes.cn/page/202401/1305718.shtml

Comments

Post a Comment