Sharing of M&A Experience --- > Need to make good use of these few skills to avoid investing in questionable investees!

1) QUALITY OF EARNING ANALYSIS via NORMALISATION ADJUSTMENT

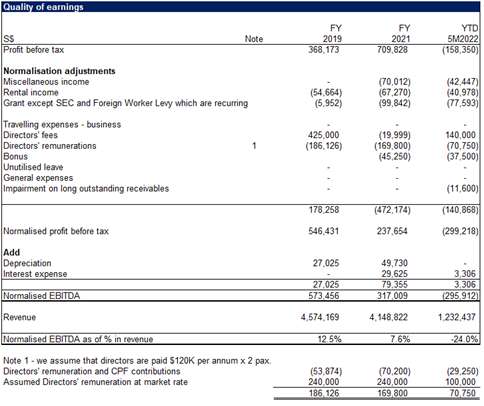

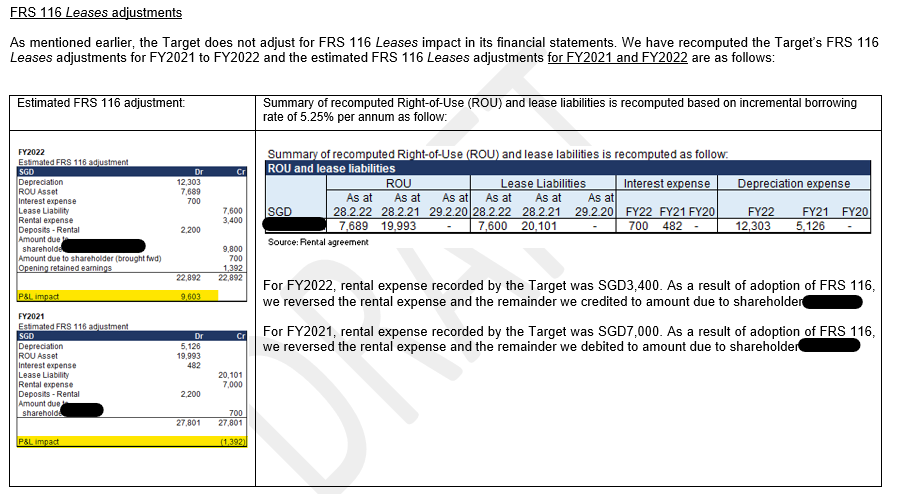

The quality of earnings analysis (prepared on pre SFRS(I) 16 Leases basis) is shown below:

Analysis from Normalisation of Profit or Loss: -

Normalised EBIT and EBITDA has been declining consistently over the review period and it moves in tandem with revenue.

We wish to highlight that the Target is incurring losses in the current period. Assuming operating expenses are kept constant throughout FY2022, the Target needs to generate $3,621K to break even.

Impact from Normalisation of Profit or Loss: -

EBITDA from year to year become much more comparable under normal circumstances.

Indeed Year 2020 result was excluded because the Target's business was seriously affected by Covid-19.

2) IDENTIFICATION OF RELATED PARTY TRANSACTIONS WHICH INVOLVED KMP via HANDSHAKE REPORTS

The above are just my sharing to clarify that for every investment made, there is a need to perform normalisation of financial statements because there are many non-recurring items inside the financial statements which will distort the performance and affect decision making process!

It is also crucial to obtain Handshake Reports where you deem it critical!

Last but not the least, always perform Adjustment arising from either early adoption or non-adoption of newly released Financial Reporting Standards!

Some FRSs are meaningless for Investors!

I will share in my next sharing if I have time!

The above are extracted and modified from my M&A involved Malaysia and Singapore businesses for education purpose. I have also done for USA, Cayman Islands, British Virgin Island, HK and China.

Comments

Post a Comment